This article was originally published on Zephyr Globe here.

Earned Value Management is a well known technique used in Project Management, that can be effectively applied to Cloud FinOps within the ‘Quantify Business Value’ domain. I have discussed this theme in my article Applying Earned Value Management (EVM) to FinOps Cloud Cost Management. I strongly recommend that you start from there, if you are not familiar with this technique.

Assumptions

For an effective EVM calculation, we have to assume that the following artifacts are present.

- Well defined and understood Unit Economics. This is one of the Capabilities within the ‘Quantify Business Value’ domain. We assume that there is an Unit Economics target for the budgeting period. For example, X cost per order target for the year.

- An established Budget for the budgeting period. More specifically, a plan of how much you think you are going to spend on each time division within your budget cycle. I recommend that you have a monthly number if the budgeting cycle is yearly, to say the least. This budget or Plan Value (PV) is an output of the Budgeting and Planning & Estimating capabilities.

Before we start

Earned Value, % Complete and Unit Economics

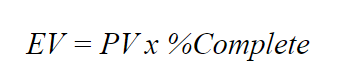

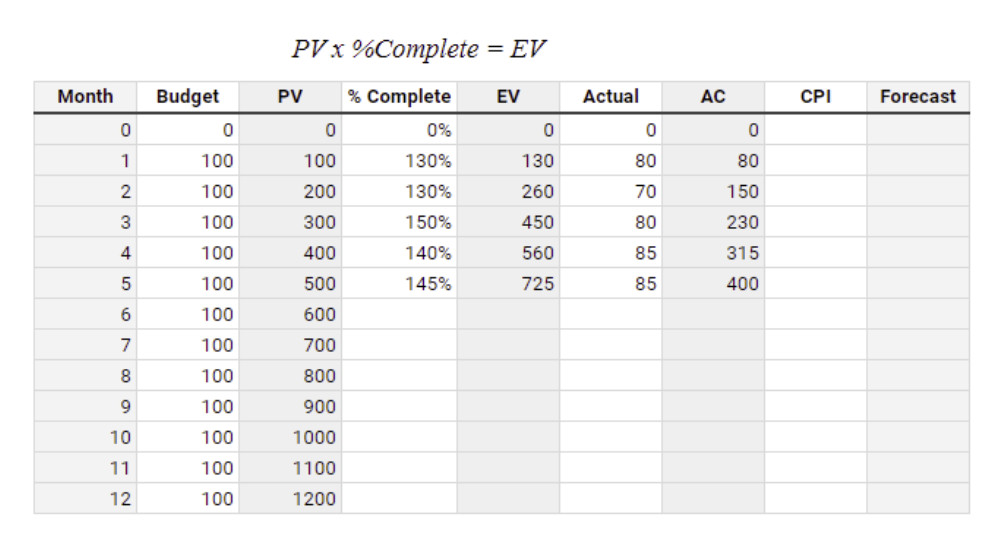

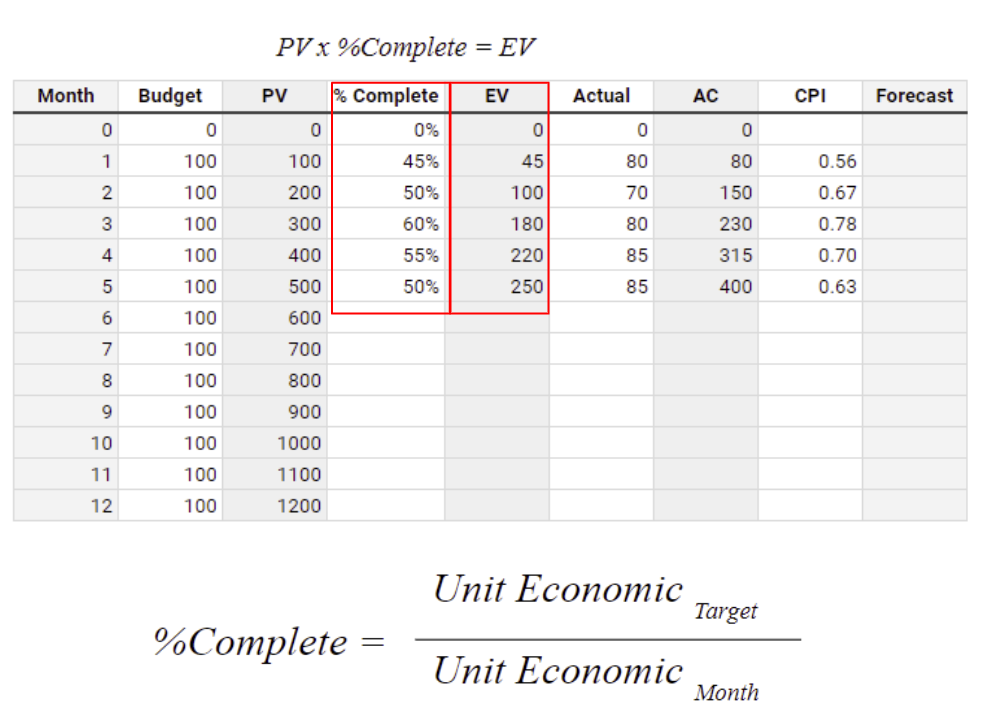

Earned Value (EV) is the result of Planned Value (PV) times %Complete. Remember that both EV and PV are cumulative for the assessing period. By assessing period, we mean the “the cumulative amount until the month we are doing the analysis”. For example, PV of March is the cumulative amount of the 3 first months of the year.

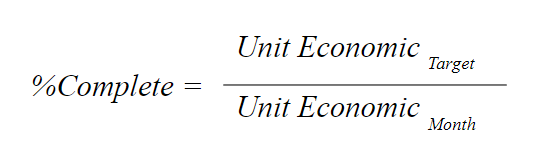

For FinOps, % Complete is the relation between Unit Economic on the assessing period with the target Unit Economic. For example, in March, our cumulative cost per order is $0.54 and our target cost per order is $0.50.

Calculating Earned Value Management.

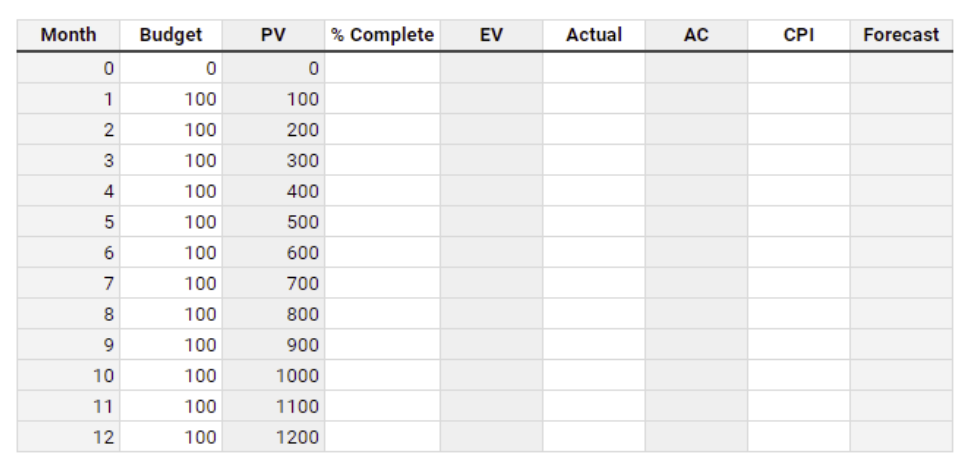

Let’s use a simple example to demonstrate how this can be calculated. Consider a budgeting cycle of a year, starting in January and finishing in December. For simplicity, consider that the monthly spend is estimated at $100 flat. PV is the cumulative amount at any given month.

Scenario 1 – Under Budget.

Consider that we are assessing the month 5 (May) and that the calculated figures of %Complete, Actual Cost and cumulative Actual Cost (AC) are as follow:

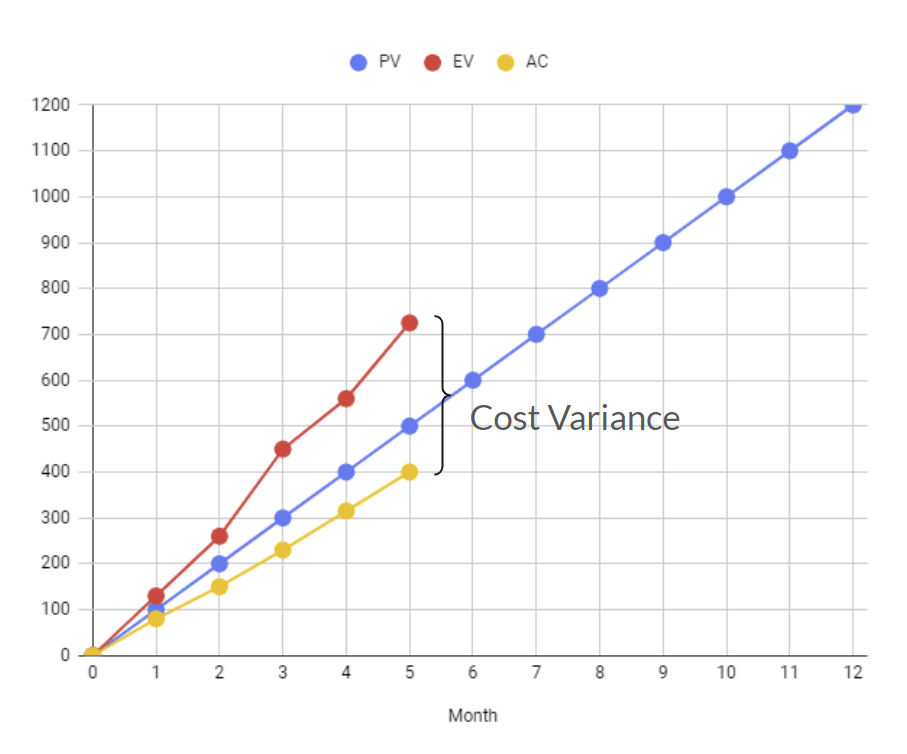

Let’s put these numbers in a graph and discuss it a little further.

The cost variance is the difference between Earned Value and Actual Cost. This is the real value that we have earned up until that point in time.

Earned Value takes into consideration the business value by accounting expected and real Unit Economics.

Scenario 2 – Over Budget

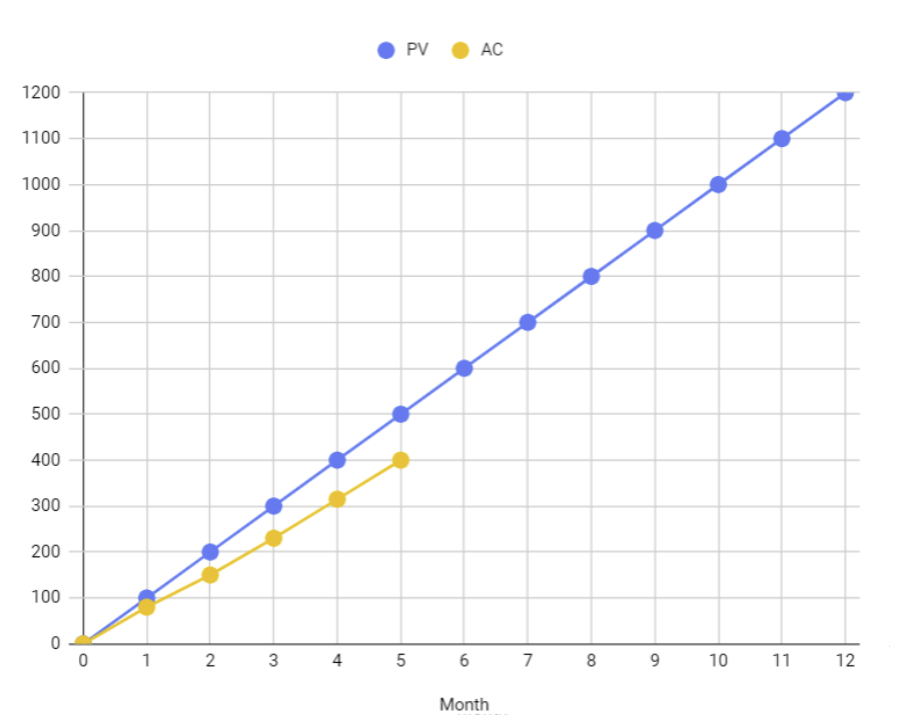

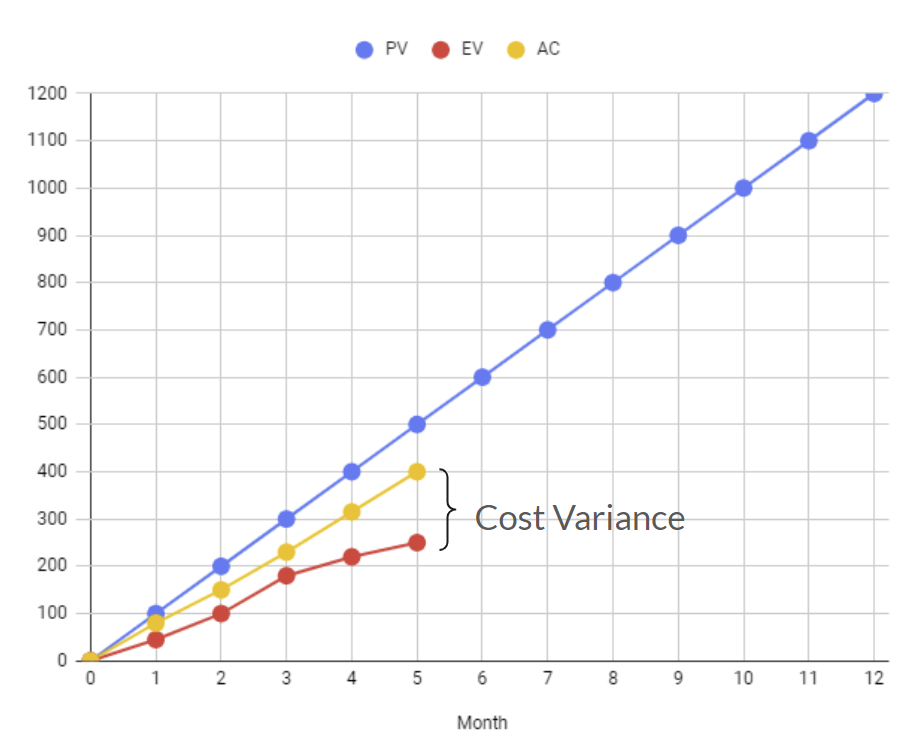

Now let’s consider that, although PV and AC are the same, %Complete went differently, as unit economics were not according to what was expected.

If only Actuals and Plan were considered, we could be deceived by the apparent positive result of $25 under. But in reality, when we compare Actuals (AC) against Earned Value, we will see that we are actually $150 over. In other words a negative Cost Variance of -$150.

The conclusion of this scenario is that, although we are spending less than what was planned, we are not reaching the expected business value due to a negative cost variance.

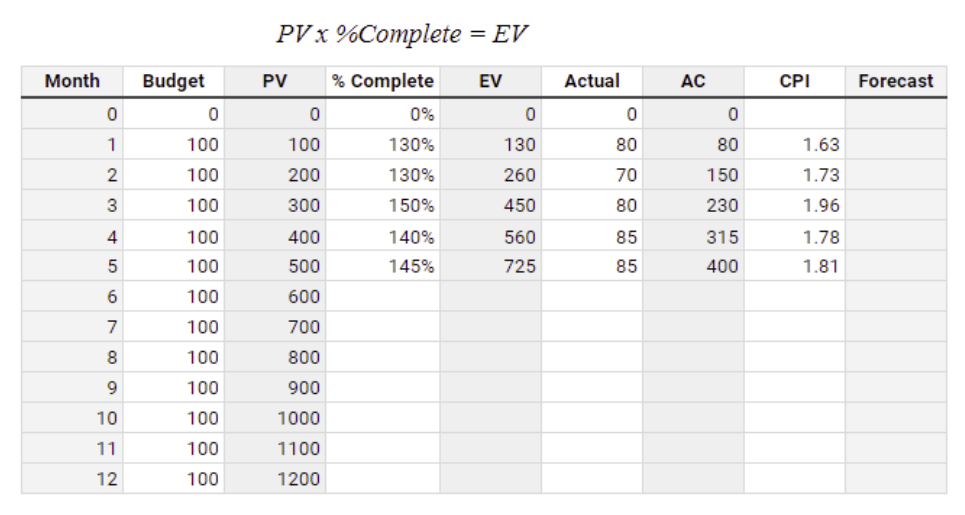

Cost Performance Indicator

Cost Performance Indicator (CPI) is obtained by dividing Earned Value (EV) by Actual Cost (AC).

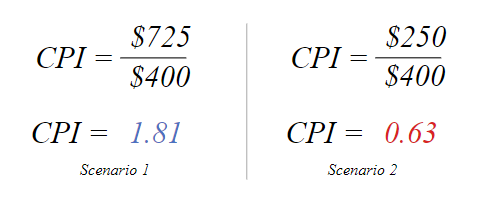

If we apply this formula for the two scenarios, here is what we get:

So, for Cost Performance Indicator, if:

- CPI is higher than 1, we are spending less to achieve business results.

- CPI is lower than 1, we are spending more and missing the target.

- CPI is equal 1, we are progressing according to the plan.

Turns out that CPI becomes a good indicator as with just one number we are able to know if our cloud spend is delivering the value expected.

Conclusion

Although the Earned Value Management (EVM) approach to FinOps that I’m proposing may sound new, the technique itself has been out there for many years. The terms like AC, EV and PV may not relate to the terms used in our day-to-day cloud cost management routine. But my intent on sticking to it is to allow everybody to take advantage of the enormeus amount of posts, articles, videos and more that have been created about EVM throughout the years.

The good thing about EVM is that it condenses in a few indicators the real situation of cost compared to expected business results and quantifies it in monetary figures.

We have briefly introduced the Cost Performance Indicator (CPI), that is an effective way to put together, in just one number, the real actual spent compared to plan and business outcomes. Of course, it is not a magical number. It should be seen as it is: an indicator. A means to quickly assess the state of the affairs and trigger the necessary discussions.

Taking advantage of Earned Value Management at cloud FinOps comes with a price. At least early maturity in capabilities like Planning & Estimating, Budgeting and Unit Economics should be in place to enable the necessary inputs for proper Reporting and Analytics.

Would you like to here more about EVM FinOps and Business Value in Cost Allocation, join our webinar on Dec. 4 with Anderson Oliveria and Shahaf Galili. Sign up here.

Disclaimer: The information provided here is for educational purposes only. For specific advice related to your organization’s context, feel free to get in touch. 📊💡