In the world of FinOps, much has been written about data democratization and cross-functional collaboration. However, one of the most critical challenges often goes unnoticed: data standardization.

Why Data Standardization Matters

For organizations focused on data-driven decision-making, data democratization—the ability to make data accessible across all levels—is essential. It enables teams in finance, engineering, and business to work from a common pool of insights, fostering transparency, accountability, and more informed decision-making. This also helps bridge the language gap between engineering, product, and finance teams, establishing clear processes and practices for cross-functional collaboration.

While these aspects are crucial, data standardization may be even more vital, yet it often remains overlooked. Without consistent cost standards, democratized data can lead to confusion rather than clarity. FinOps teams may use sophisticated dashboards and reporting tools to track spending, but when they delve into a more complex cost view—such as the expense of a particular feature, customer, or application—they often find themselves lost in conflicting metrics. This inconsistency stems from a lack of standardized definitions and measurement practices.

Imagine a company trying to determine the cost of delivering a new AI feature to customers. Engineering might consider both the workload and model costs, finance might focus on tagged resources, and product teams might only look at the AI service cost. Each department uses different numbers, leading to a fragmented view that hinders effective decision-making. For example, determining the gross margin of a customer becomes challenging when the COGS and CAC for that customer aren’t clear, unified, or based on a transparent calculation.

Standardizing Unit Costs in the Cloud

When there’s no standardized way to measure accurate unit costs in the cloud, teams arrive at different conclusions, resulting in inefficiencies and missed opportunities for organization-wide optimization. Taking action on unstandardized cost data is challenging, as discrepancies can always be questioned, undermining cost-effectiveness. The more granular the data—and the more you wish to leverage it in FinOps—the stronger the need for a clear standard. As organizations adopt more advanced FinOps practices, such as tracking costs at a granular level for specific customers or features, the lack of standardization becomes even more problematic. Companies often rely on metrics like API calls or incoming traffic, but these measurements are rarely consistent across teams or even quarters, leading to inaccurate results that can disrupt budgets and planning.

In advanced FinOps, which aims to drive business forward beyond mere optimization and cost-cutting, true value isn’t just about democratizing data—it’s about ensuring that everyone interprets the same numbers in the same way and understands how they are calculated. As companies progress into the “Run” stage of FinOps, the need for cross-departmental alignment around standardized data becomes increasingly urgent. Data democratization, communication, and collaboration are necessary but insufficient if they aren’t supported by rigorous data standardization.

To fully unlock the potential of FinOps, organizations must address this hidden challenge.

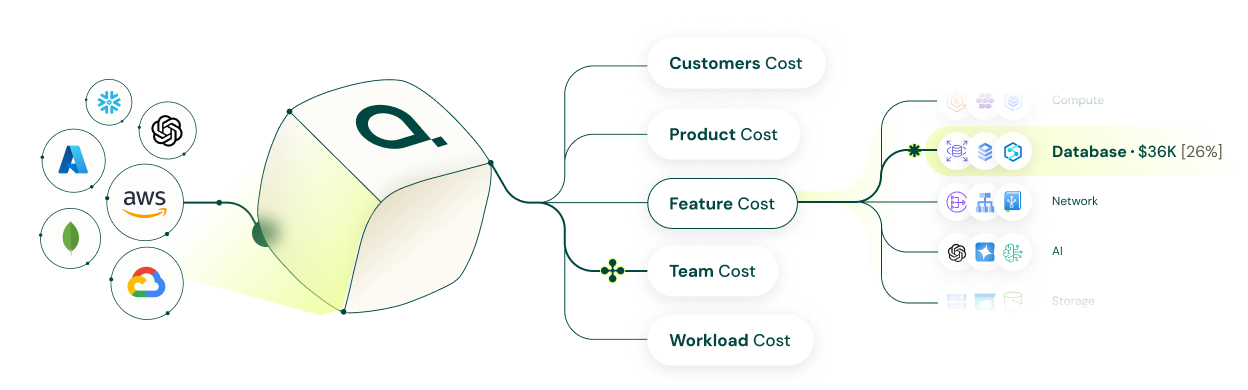

Automated Cost Calculation with Attribute

At Attribute, we are helping our customers tackle this issue. Our system is designed to automatically calculate the cost of a business unit, team, customer, feature, or any other value that companies need to monitor in the cloud. Our solution delivers highly accurate calculations based on granular visibility and real usage data. When attributes measure the exact usage of a feature, rather than relying on tagging or general, inaccurate calculations, the cost data becomes clear and standardized. All relevant parties can agree on that cost, making it easier to drive action across the organization. Teams can make truly informed, consistent, and strategic decisions that align with the organization’s financial goals.

In doing so, companies not only enhance cost visibility but also empower every department to make decisions based on a shared foundation of data—transforming FinOps from a simple operational tool into a powerful driver of business success.