FinOps has been traditionally focused on cost savings. However, solely concentrating on reducing expenses is a limited view, one that misses the broader business opportunities cloud adoption can bring. Cost reduction is a tactic, not a strategy. By going beyond cost savings, FinOps can be a key player for driving business outcomes.

For example, financial insights from cloud data can help launch new products, optimize sales strategies, improve user experiences, optimize pricing strategies, improve user experiences, help enter new markets, and more.

In a fascinating conversation between Stephen Old and Frank Contrepois, from the “What’s New in Cloud FinOps” podcast, and Izhak Zimmerman, CEO and co-founder of Attribute, they discuss how new FinOps approaches can help all departments across the organization make better business decisions.

Some of the top insights discussed include:

1. FinOps Without Tagging

Traditional FinOps is based on tagging. However, tagging is a time-consuming, error-prone and meticulous process. It requires constant upkeep and enforcement, creates silos and is based on a dated technology going back 15 years ago to 2010. This means it is also lacking when it comes to mapping and analyzing shared resources like Kubernetes, databases, storage, network and AI. Tagging also focuses on mapping resources, rather than how they were used. These shortcomings create a lack of trust in traditional FinOps outputs, significantly hindering the speed of cloud adoption and financial transparency.

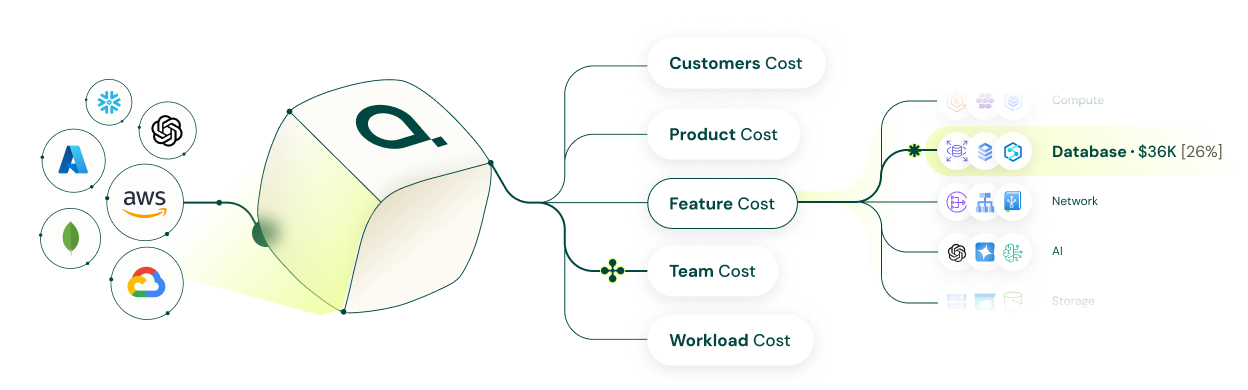

Instead, using advanced networking data and eBPF sensors can help infer the relationships between different cloud components and understand the protocol level of data. This granularity enables grouping user actions at the application level and based on business context, allowing the shift to business-value FinOps.

2. Cloud Costs as a Strategic Business Asset

The focus of the FinOps movement is shifting from just cost savings to understanding and maximizing the business value derived from cloud investments. By realizing the true cost and value of cloud operations, organizations can make data-driven decisions about which customer segments, products, or features to prioritize, ensuring that cloud investments yield positive ROI.

This is also where traditional FinOps optimization strategies hit a ceiling, necessitating new approaches that align financial management with business outcomes.

3. Democratizing The Business Value of Costs

Strategically, the real value of FinOps insights lies in making the data accessible across the company, including non-technical personas. Standardization of how cloud spend is interpreted—whether it’s COGS, cloud bills, or other metrics—ensures a consistent understanding of costs across departments. This allows stakeholders across all teams, like finance, product and DevOps, to make informed business decisions.

For example:

- CFOs can provide precise forecasting and cost management plans

- Product teams can assess feature profitability

- DevOps trust recommendations and insights, since they have full context

Making data accessible can be done by:

- Translating technical data into business metrics

- Integrating data into business platforms like Salesforce

- Creating dashboards for different user needs

- Fostering a culture of collaborative and standardized data-driven decision making.

Cloud transformation is not just about optimizing cloud spending—it’s about optimizing the business, i.e aligning investments with the strategic goals of the business.

Listen to more insights from the full episode here.